India Tax's Email Addresses

India Tax's Phone Numbers

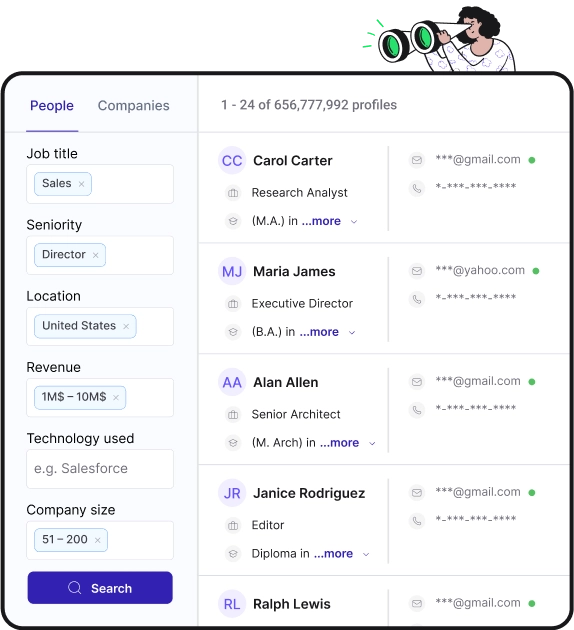

Find personal and work emails for over 300M professionals

Not the India Tax you were looking for? Continue your search below:About India Tax

📖 Summary

India is home to a diverse and dynamic economy, and as such, the country's tax system is equally complex. The Indian tax system comprises a variety of taxes, including income tax, corporate tax, goods and services tax (GST), and customs duty, among others. These taxes play a crucial role in the functioning of the Indian government, providing funds for public services, infrastructure development, and social welfare programs.

The primary authority responsible for administering taxes in India is the Central Board of Direct Taxes (CBDT) and the Central Board of Indirect Taxes and Customs (CBIC). These bodies oversee the collection of taxes and the enforcement of tax laws across the country. Additionally, individual states within India also have the authority to levy and collect certain taxes, such as state excise duty and stamp duty.

One of the most significant taxes in India is the income tax, which is levied on the income of individuals and businesses. The income tax system in India is progressive, meaning that those with higher incomes are subject to higher tax rates. The tax rates for individuals are divided into different slabs based on their income, with the highest tax rate currently at 30%. For corporations, the tax rate is generally 25%, although there are certain provisions that may apply to specific industries or types of companies.

In recent years, the Indian government has taken steps to simplify the tax system and enhance compliance. The introduction of the Goods and Services Tax (GST) in 2017 was a significant reform aimed at unifying India's indirect tax system. The GST replaced a myriad of state and central taxes, creating a single, nationwide tax on the supply of goods and services. This has streamlined the tax compliance process for businesses and reduced the tax burden on consumers.

Another important aspect of the Indian tax system is tax planning and compliance. Tax planning involves making strategic financial decisions to minimize tax liabilities while complying with the law. This may include utilizing tax-saving investment instruments, taking advantage of deductions and exemptions, and structuring business transactions in a tax-efficient manner. Tax compliance, on the other hand, refers to fulfilling all legal obligations related to tax payment, filing returns, and maintaining accurate financial records. Non-compliance with tax laws can result in penalties, fines, and legal action by the tax authorities.

Finally, the Indian tax system is also subject to ongoing changes and updates through government budgets and legislative amendments. These changes can impact tax rates, deductions, exemptions, and reporting requirements, requiring individuals and businesses to stay informed and adapt their tax strategies accordingly. Overall, navigating the Indian tax system requires a deep understanding of the various taxes, compliance requirements, and planning opportunities, making it essential for individuals and businesses to seek professional advice to ensure their tax affairs are managed effectively.

India Tax's Email Addresses

India Tax's Phone Numbers

People you may be

interested in

American model

Football coach

Canadian-American actor

Singer and songwriter

Actor

American actress

American gospel singer and evangelist

American actress and model

Actress

News presenter

American filmmaker and studio executive

CEO of Twitter